Streamlining Coverage Worldwide: Insurance Automation Market Insights to 2031

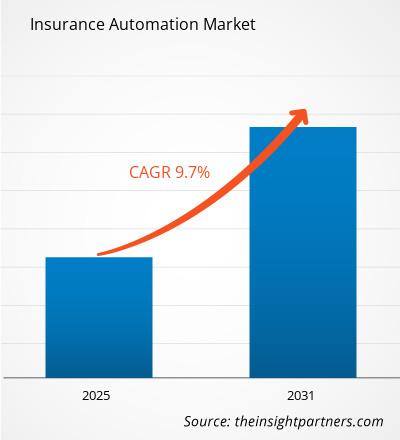

Pune, India - Insurance automation streamlines everything from claims processing to policy underwriting, making coverage faster and more reliable for everyday people and businesses alike. These smart systems use AI and robotics to handle repetitive tasks, freeing agents to focus on personal service that builds real trust. The Insurance Automation Market is expected to register a CAGR of 9.7% from 2025 to 2031.

Market Size, Share, Trends, Analysis, and Forecast by 2031

Global Overview: The insurance automation market grows steadily through 2031, driven by digital shifts that prioritize speed and accuracy in customer interactions.

Market Share Dynamics: Solutions like RPA dominate shares over services, with cloud deployments overtaking on-premise for flexibility.

Key Trends: AI integration for fraud detection and chatbots reshapes operations, while personalized policies via data analytics become standard.

Analysis Highlights: Claims processing leads applications, followed by compliance, as enterprises seek end-to-end efficiency.

Forecast to 2031: Expansion continues with IoT and ML advancements, sustaining momentum across large and small insurers.

Global and Regional Analysis

North America leads with tech-savvy insurers in the US adopting RPA for competitive edges. Europe emphasizes regulatory compliance through automation in the UK and Germany. Asia-Pacific surges fastest, fueled by digital booms in India and China amid massive policyholder growth. Latin America and Middle East & Africa gain ground via mobile-first solutions and rising insurtech adoption.

Key Drivers Accelerating Market Growth

Digital transformation pushes insurers to automate for quicker claims and better satisfaction, cutting manual errors that frustrate customers. Rising fraud demands AI-powered detection, while customer expectations for instant service via apps drive chatbot and personalization tools. Cost pressures favor RPA for back-office tasks, enabling scalability as policies multiply.

Get More Information: -

https://www.theinsightpartners.com/reports/insurance-automation-market

Key Players

Acko General Insurance

IBM Corporation

Microsoft Corporation

Shift Technology

Zurich Insurance Group

Lemonade

Cape Analytics LLC

Trov

Quantemplate

ZhongAn.

Emerging Trends and Market Opportunities

AI/ML for predictive underwriting opens doors to hyper-personalized premiums based on real-time data. IoT integration in usage-based insurance creates niches for automated risk assessment. Low-code platforms empower smaller firms, while blockchain enhances secure claims sharing. Expansion into emerging markets via mobile automation taps underserved populations.

Recent Industry Developments

In 2025, UiPath expanded RPA suites for insurance claims, reducing processing times dramatically. Salesforce launched Einstein for Insurance, boosting personalization. IBM partnered with carriers for AI fraud tools amid rising cyber threats. Oracle updated its Fusion platform with enhanced automation for compliance. These steps reflect a industry-wide push toward resilient, customer-centric operations.

Conclusion

Insurance automation reshapes how protection reaches people, blending tech with human touch for seamless experiences worldwide. As innovations mature and regions digitize, this field promises greater accessibility and trust for all. Forward-looking providers will thrive by embracing these changes head-on.

About The Insight Partners

The Insight Partners is a global leader in market research, delivering comprehensive analysis and actionable insights across diverse industries. The company empowers decision-makers with data-driven intelligence to navigate evolving markets and accelerate growth.

Contact Us:

Contact Person: Ankit Mathur

E-mail: ankit.mathur@theinsightpartners.com

Phone: +1-646-491-9876

Also Available in :

Korean | German | Japanese | French | Chinese | Italian | Spanish

Streamlining Coverage Worldwide: Insurance Automation Market Insights to 2031

Pune, India - Insurance automation streamlines everything from claims processing to policy underwriting, making coverage faster and more reliable for everyday people and businesses alike. These smart systems use AI and robotics to handle repetitive tasks, freeing agents to focus on personal service that builds real trust. The Insurance Automation Market is expected to register a CAGR of 9.7% from 2025 to 2031.

Market Size, Share, Trends, Analysis, and Forecast by 2031

Global Overview: The insurance automation market grows steadily through 2031, driven by digital shifts that prioritize speed and accuracy in customer interactions.

Market Share Dynamics: Solutions like RPA dominate shares over services, with cloud deployments overtaking on-premise for flexibility.

Key Trends: AI integration for fraud detection and chatbots reshapes operations, while personalized policies via data analytics become standard.

Analysis Highlights: Claims processing leads applications, followed by compliance, as enterprises seek end-to-end efficiency.

Forecast to 2031: Expansion continues with IoT and ML advancements, sustaining momentum across large and small insurers.

Global and Regional Analysis

North America leads with tech-savvy insurers in the US adopting RPA for competitive edges. Europe emphasizes regulatory compliance through automation in the UK and Germany. Asia-Pacific surges fastest, fueled by digital booms in India and China amid massive policyholder growth. Latin America and Middle East & Africa gain ground via mobile-first solutions and rising insurtech adoption.

Key Drivers Accelerating Market Growth

Digital transformation pushes insurers to automate for quicker claims and better satisfaction, cutting manual errors that frustrate customers. Rising fraud demands AI-powered detection, while customer expectations for instant service via apps drive chatbot and personalization tools. Cost pressures favor RPA for back-office tasks, enabling scalability as policies multiply.

Get More Information: - https://www.theinsightpartners.com/reports/insurance-automation-market

Key Players

Acko General Insurance

IBM Corporation

Microsoft Corporation

Shift Technology

Zurich Insurance Group

Lemonade

Cape Analytics LLC

Trov

Quantemplate

ZhongAn.

Emerging Trends and Market Opportunities

AI/ML for predictive underwriting opens doors to hyper-personalized premiums based on real-time data. IoT integration in usage-based insurance creates niches for automated risk assessment. Low-code platforms empower smaller firms, while blockchain enhances secure claims sharing. Expansion into emerging markets via mobile automation taps underserved populations.

Recent Industry Developments

In 2025, UiPath expanded RPA suites for insurance claims, reducing processing times dramatically. Salesforce launched Einstein for Insurance, boosting personalization. IBM partnered with carriers for AI fraud tools amid rising cyber threats. Oracle updated its Fusion platform with enhanced automation for compliance. These steps reflect a industry-wide push toward resilient, customer-centric operations.

Conclusion

Insurance automation reshapes how protection reaches people, blending tech with human touch for seamless experiences worldwide. As innovations mature and regions digitize, this field promises greater accessibility and trust for all. Forward-looking providers will thrive by embracing these changes head-on.

About The Insight Partners

The Insight Partners is a global leader in market research, delivering comprehensive analysis and actionable insights across diverse industries. The company empowers decision-makers with data-driven intelligence to navigate evolving markets and accelerate growth.

Contact Us:

Contact Person: Ankit Mathur

E-mail: ankit.mathur@theinsightpartners.com

Phone: +1-646-491-9876

Also Available in :

Korean | German | Japanese | French | Chinese | Italian | Spanish